dupage county sales tax rate 2020

The latest sales tax rate for Woodridge IL. 2020 DuPage County Tax Rate Booklet.

Business Climate Choose Dupage

This is the total of state and county sales tax rates.

. DuPage County Administration Building. Our website is available 247 as is our online payment program. Special Road and Trail Event Permit.

This is the total of state and county sales tax rates. The Du Page County Illinois sales tax is 700 consisting of 625 Illinois state sales tax and 075 Du Page County local sales taxesThe local sales tax consists of a 075 special district. 2020 rates included for use while preparing your income tax deduction.

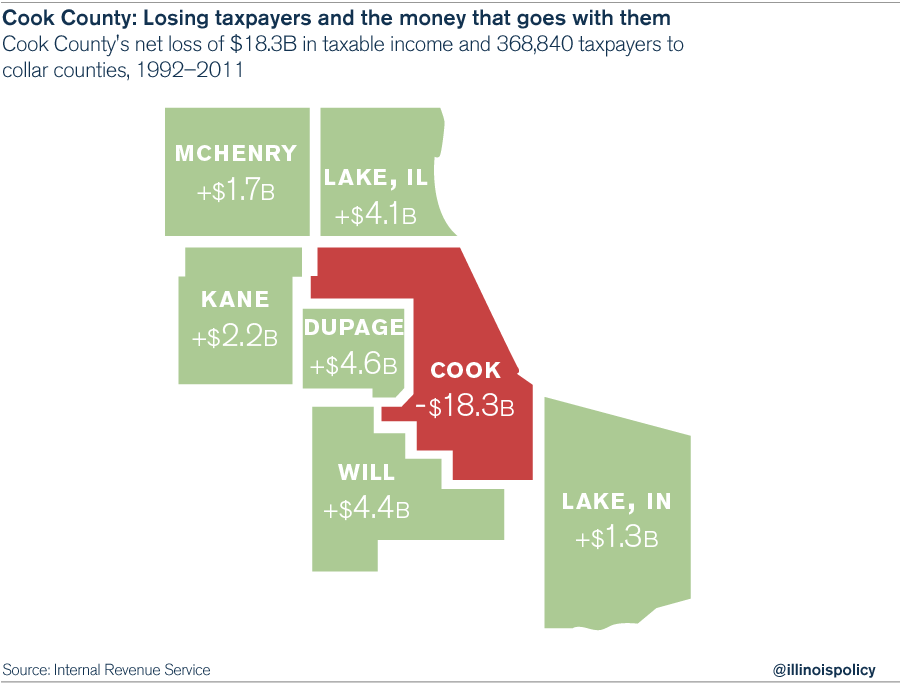

2020 rates included for use while preparing your income tax deduction. Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes. The 105 sales tax rate in Bartlett consists of 625 Illinois state sales tax 175 Dupage County sales tax 15 Bartlett tax and 1 Special tax.

What is the sales tax rate in Dupage County. County Farm Road Wheaton IL 60187. The tax levies are.

Beginning May 2 2022. This is the total of state and county sales tax rates. This rate includes any state county city and local sales taxes.

This includes a full list of taxing districts in the county with their tax rates. Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County.

This rate includes any state county city and local sales taxes. The latest sales tax rate for DuPage County IL. Our website allows you to print a duplicate tax bill pay your bill see assessment information view 5 years of property tax history.

You have up to the day immediately before the sale to pay all. DuPage County collects on average 171 of a propertys assessed. Illinois IL Sales Tax Rates by City all The state sales tax rate in Illinois is 6250.

The latest sales tax rate for Lombard IL. Average Sales Tax With Local. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900.

2020 rates included for use while preparing your income tax deduction. 1337 rows 2022 List of Illinois Local Sales Tax Rates. This rate includes any state county city and local sales taxes.

The December 2020 total local sales tax rate was also 7000. The minimum combined 2022 sales tax rate for Dupage County Illinois is. With local taxes the total sales tax rate is between 6250 and 11000.

This rate includes any state county city and local sales taxes. Illinois has recent rate. The sales tax jurisdiction name is Elgin.

The Illinois state sales tax rate is currently. The 2021 annual real estate Tax Sale will begin on Thursday November 17 2022. DuPage County IL Government Website with information about County Board officials.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Illinois has a 625 sales tax and Dupage County collects an additional. The median property tax on a 31690000 house is 332745 in the United States.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. Payments and correspondence may always be mailed directly to the DuPage County Treasurers Office at 421 N. DuPage County IL Government Website with information about County Board officials.

If your Property Taxes are Sold at the Annual Tax Sale Held on November 1718 2022. Property Tax Rate and Extension Reports. It will continue until all delinquent parcels are sold.

The latest sales tax rate for Addison IL. 2020 rates included for use while preparing your income tax deduction.

Week Ending Aug 27 Dupage County Home Sales Dupage Policy Journal

Sales Tax On Car In Dupage County

Illinois Sales Tax Rates By City County 2022

Dupage County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Chicago Leasers Clarification Please Ask The Hackrs Forum Leasehackr

2019 Senior Freeze Applicaiton 2019 1 Pages 1 4 Flip Pdf Download Fliphtml5

Illinois Property Taxes By County 2022

Illinois Sales Tax Rate Rates Calculator Avalara

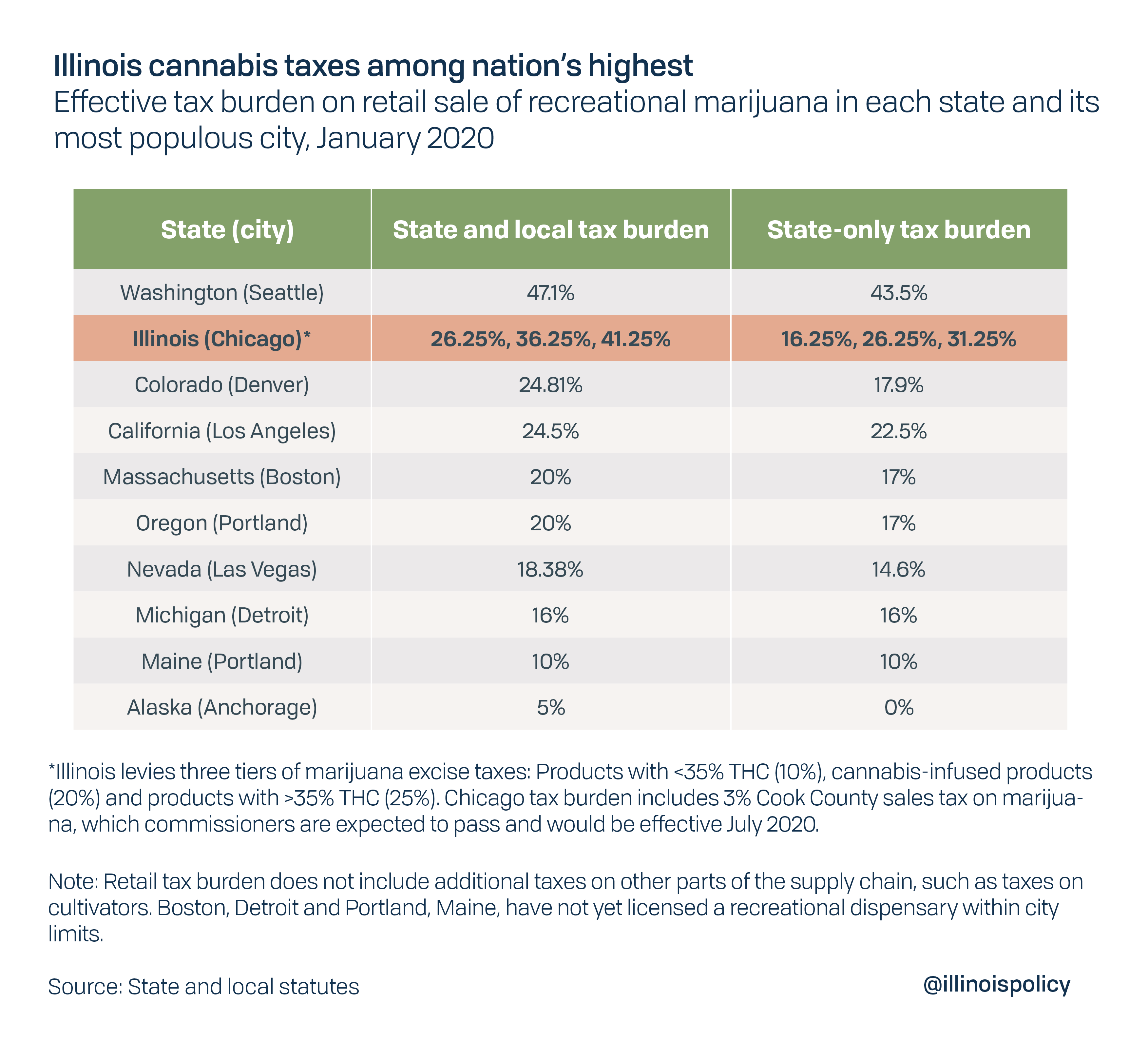

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

Sales Tax On Car In Dupage County

Transportation Logistics And Warehousing Choose Dupage

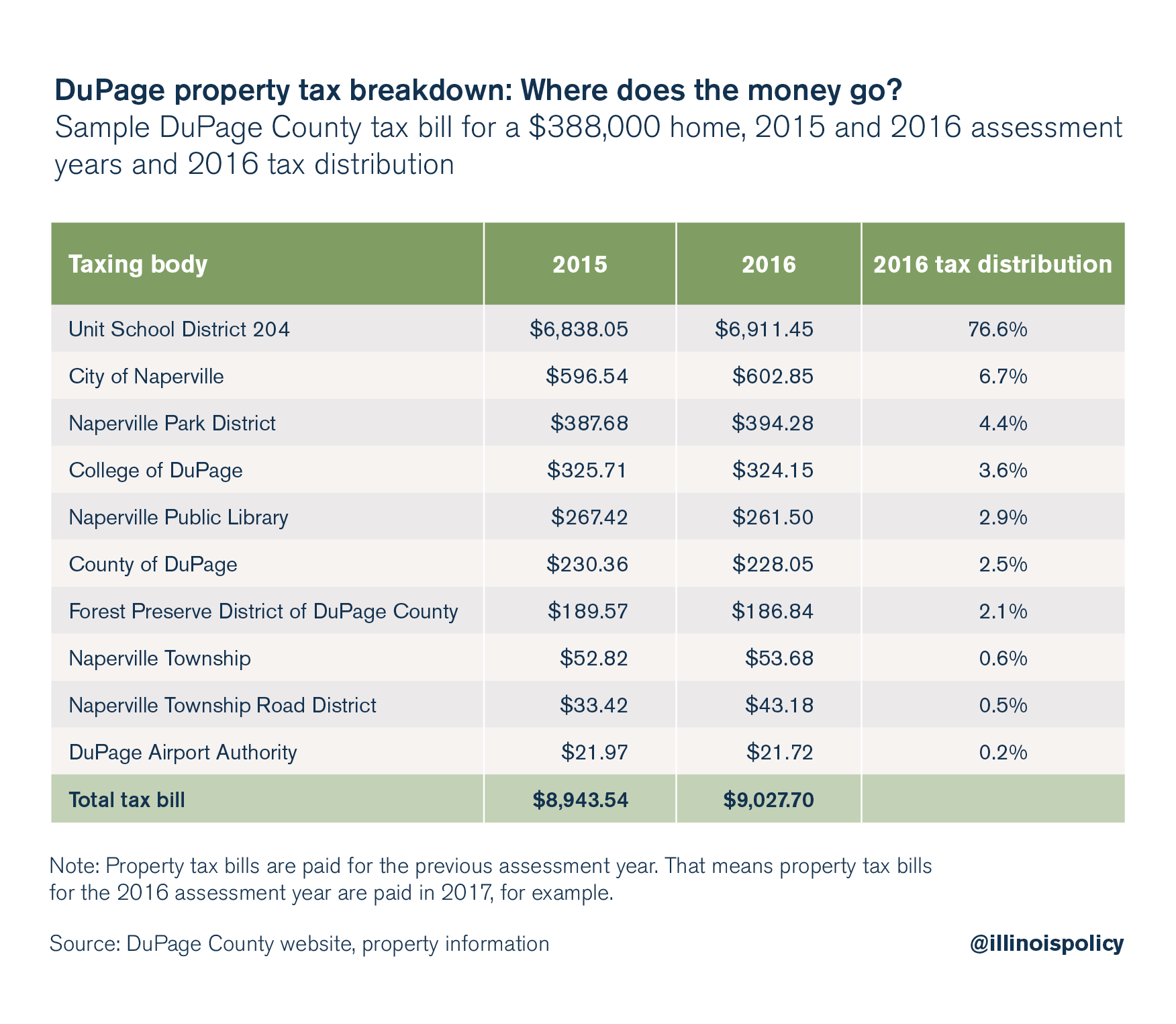

Dupage County Homeowners Where Do Your Property Taxes Go

Dupage County Proposes Seventh Year Of Not Raising Property Tax Rates Illinois Thecentersquare Com

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

List Of Real Estate Tax Exemptions In Dupage County

Sales Tax Village Of Carol Stream Il

Illinois Trade In Tax Credit Lombard Toyota

What You Need To Know About The Graduated Income Tax Proposal On Your Ballot This Election Nbc Chicago